Therefore, employees who receive such payments in lieu of notice as from 1 April onwards are chargeable to salaries tax. Should we submit a form IR56B in respect of each person's realized gains? In addition, you should also state the number of shares that can be exercised after termination of employment; and the date on which the relevant share options were granted to that employee. I do not know how it was calculated. Points to Note when making annual employer's return a Prepare payroll information For 1 April to 31 March of the following year. On his leaving Hong Kong for good or for a substantial period of time You have to ascertain from the employee his expected date of departure. However, for critical errors e.

| Uploader: | Shashura |

| Date Added: | 9 February 2009 |

| File Size: | 40.64 Mb |

| Operating Systems: | Windows NT/2000/XP/2003/2003/7/8/10 MacOS 10/X |

| Downloads: | 63299 |

| Price: | Free* [*Free Regsitration Required] |

In addition, you should also state the number of shares that can be exercised after termination of employment; and the date on which the relevant share options were granted to that employee. If I leave employment on 15 October and remain unemployed until 30 November Design My Vector Use this option to design your vector using our online platform. For details, see What tax obligations do I have as an Employer?

But if you find all information has already been properly inputted, the triangle mark displayed should be likely due to the incomplete validation of this record when you saved the draft return file previously. After designing a vector, add it to your cart.

Hence, form IR56Bs must be completed for the kr56e year ended 31 March. I print my own form IR56B, the format of which is the same as those issued by the Inland Revenue Department to the employers?

Vectors for Fruitfly Ir56e

Please click here for more details on taxation of share awards and share options. Apart from the package tour fee, should the visa fee and insurance premium be included as Employee A's taxable income? You and your subsidiaries should file separate employer's returns. You then have to follow up with the employee. The department will examine the facts and circumstances of each case carefully to determine the date on which the payment in lieu of notice accrued.

Mammalian Gene Expression Adenoviral Vector. Payments in lieu of notice contractually agreed include sums made by employers to employees under section 7 of the Employment Ordinance. In the circumstance described by you, you should file the following forms in respect of this employee, namely: No, you cannot print your own paper form IR56B. Yes, they are taxable. If brainstorming was the sole purpose of the trip, the trip expenses were not taxable.

Fruitfly Ir56e vectors - Lentivirus, AAV, shRNA & CRISPR I VectorBuilder

Use this option to design your vector using our online platform. Employer B purchased a package tour to be taken by Employee A for holiday.

Subsequently when that employee has realized gains from the exercise, assignment or release of the share options, you will be required to report the amount of gains in form IR56B.

You should print the IR56Bs from your source application i.

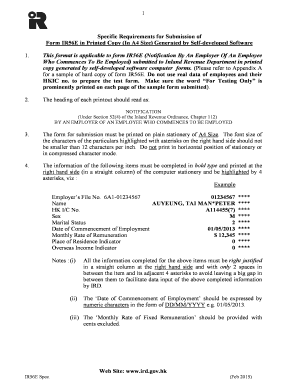

Send Design Request Use this option to ask our scientists to design your vector for free. In the notification, the employer is required to report payment in lieu of notice which accrues on ig56e after 1 April to the employee who is about to depart from Hong Kong. The download form and fax-a-form must be printed on white plain A4 size paper; printed information must be complete and legible; and each form must be signed by the same responsible person ; or IRD software for IR56B plus a duly signed Control List must use IRD software, version 3.

How would the Assessor assess me on this sum of money? As employee A joined the tour with his family members, his share of benefit should be greater than the seven other employees.

Is data import function applicable? The Inland Revenue Department will also send a copy of the acknowledgement to the designated e-mail address ir56f if you have provided the e-mail address es for receiving the copy. Why payments in lieu of notice were not assessed to tax previously? What are the requirements of the data file for uploading IR56B in the e-filing service? The forms will be sent ir56 you once the Employer's file has been opened.

Fruitfly Ir56e expression lentivirus vector. The amounts distributed to them should therefore be reported in item 11 k of the form IR56B. The iir56e expenses would be taxable on the employees. Details are described below.

No comments:

Post a Comment